Who This Service Is For

Our outsourced accounting solutions are purpose-built for:

Sole Traders and Freelancers

Individuals managing their own businesses who need reliable bookkeeping, cloud-based accounting software, and compliance-ready financials — without the complexity of juggling everything alone.

Small to Medium-Sized Enterprises (SMEs)

Businesses aiming to streamline their finances, reduce overhead, and gain expert support without building an internal finance department. Ideal for SMEs in Australia, Saudi Arabia, the UK, USA, UAE, Pakistan and beyond.

Startups & Early-Stage Businesses

Young companies in growth mode needing scalable, IFRS-compliant accounting services that evolve with them — offering budgeting, forecasting, and performance insights from day one.

International and Multi-Entity Organizations

Cross-border businesses that require consolidated reporting, localized chart of accounts, and tax-ready financials aligned with GAAP, IFRS, or other global standards.

E-Commerce & Digital-First Companies

Online sellers and subscription-based ventures needing real-time financial tracking, inventory-based bookkeeping, and support for reconciling transactions from platforms like Shopify, Stripe, or Amazon within their accounting systems.

Professional & Creative Service Firms

Consulting, marketing, IT, and legal providers who value accurate monthly financial statements and strategic reporting to support client billing, project costing, and business decisions.

What’s Included in Our Accounting Services

We deliver precise, up-to-date bookkeeping tailored for busy founders, freelancers, and multi-channel sellers. Every income and expense is tracked with care, and monthly reconciliations ensure your records align perfectly with your bank and payment platforms. Whether you’re a service-based startup or an international e-commerce brand, we maintain clean books so you’re always audit-ready and cash flow-aware.

Avoid bottlenecks and missed payments with proactive A/P and A/R tracking. We manage vendor bills, client invoicing, payment cycles, and overdue follow-ups, so you don’t have to. Ideal for SMEs and agencies with recurring billing, subscriptions, or global suppliers, this service gives you clear visibility into what’s owed, what’s outstanding, and what’s overdue — no more chasing or guessing.

We prepare IFRS- and GAAP-compliant financial statements that are investor-ready, tax-compliant, and perfectly formatted for audit or due diligence. From sole proprietors to growing international businesses, we ensure your Profit & Loss, Balance Sheet, and Cash Flow reports are not just numbers — but tools for smarter business decisions.

Designed for founders who want clarity and control, we build dynamic budgets and financial forecasts to help you plan, pivot, and prioritize. Whether you’re scaling a startup, entering a new market, or managing seasonal demand, our monthly cash flow management keeps you two steps ahead — not two months behind.

Real-time insights meet elegant reporting. Get monthly dashboards and reports that visualize your KPIs, spending trends, and profitability — customized for your business model. Perfect for service providers, international businesses, and growing teams who need to make data-driven decisions without decoding spreadsheets.

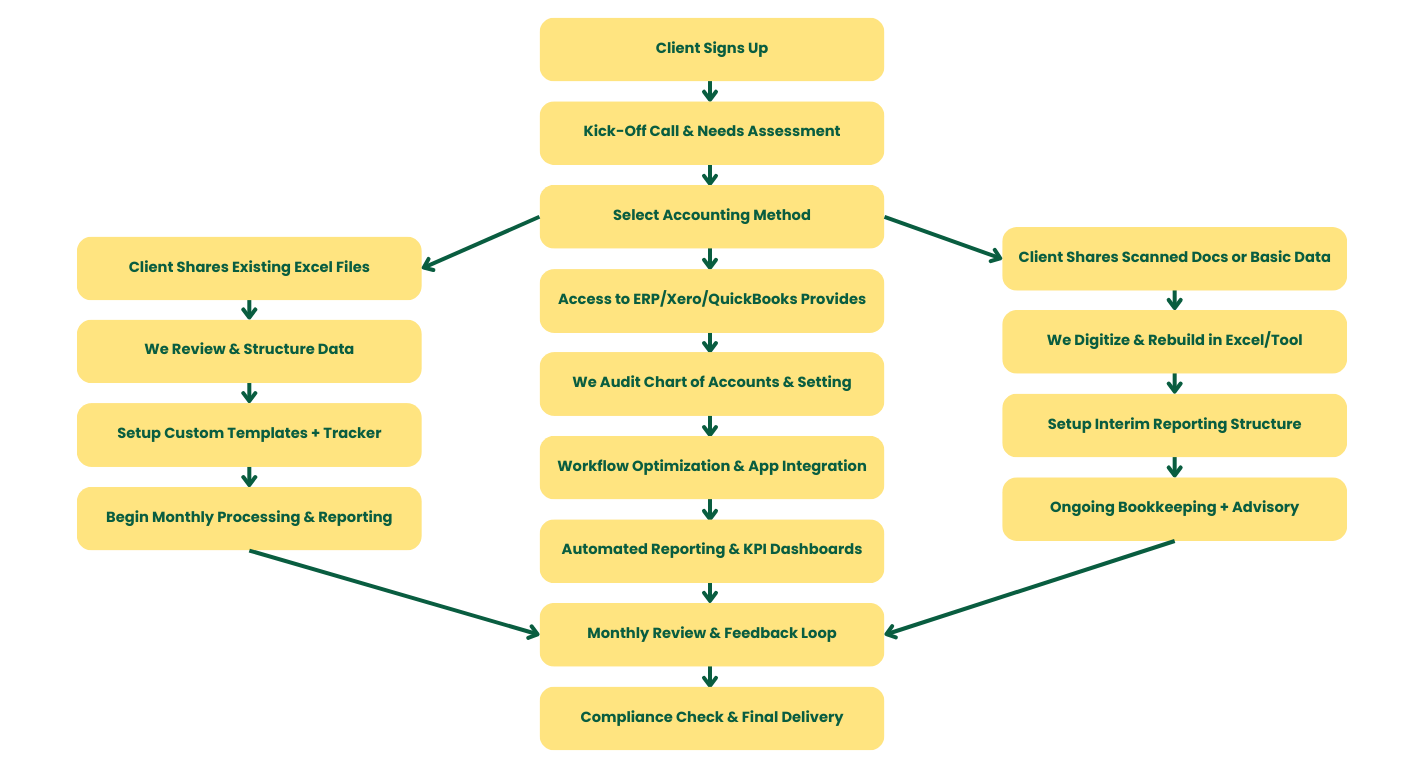

End-to-End Accounting Workflow for Expert Arm

Objective: Understand the client’s business model, entity type, industry-specific compliance needs, and scope of required services.

Tasks

- Initial consultation call (Zoom/Teams)

- Identify business structure: Sole trader, SME, Startup, E-commerce, etc.

- Determine jurisdiction-specific compliance: FBR, ATO, HMRC, ZATCA, etc.

- Sign NDA, Engagement Letter & SOW

- Collect legal business info:

- Company name, tax number (NTN, EIN, etc.)

- Entity structure, jurisdiction

- Monthly transaction volume estimate

- Nature of operations

Objective: Set up a customized accounting system based on the client’s structure and preferred platform.

Tasks

- Choose/confirm software: Xero, QuickBooks, Zoho, MYOB, Excel, Google Sheets, ERP etc.

- Set up/clean up:

- Chart of Accounts

- Bank Feeds

- Opening Balances (if switching from another accountant)

- Staff access & roles

- Determine data sharing cadence (weekly/monthly)

- Share client checklist:

- Bank & credit card statements

- Purchase/sales invoices

- Payroll reports (if externally managed)

- Loan/asset schedules

- Any pending receivables/payables

Objective: Ensure consistent, accurate recording of financial data.

Tasks

- Collect and organize:

- Sales invoices (manual/POS/e-commerce platforms)

- Purchase bills

- Bank and credit card statements

- Employee reimbursements and expenses

- Post entries:

- Categorize income/expenses by account

- Tag tax codes (GST, VAT)

- Reconcile accounts (bank, loan, petty cash)

- Record journal entries where required

Tools Used: SharePoint folders, secure email, Hubdoc/Dext for receipts (optional add-on)

Objective: Monitor and track incoming and outgoing payments for healthy cash flow.

Tasks

- Create and track vendor bills and customer invoices

- Send reminders for overdue invoices (if included in scope)

- Reconcile vendor/client accounts monthly

- Generate aged receivable/payable reports

Objective: Deliver business insights via accurate financial reporting.

Reports Delivered:

- Profit & Loss Statement

- Balance Sheet

- Cash Flow Statement

- Expense breakdown and trend analysis (optional)

- Debtors & Creditors aging report

- Tax summary reports (for VAT/BAS)

Delivery Timeline: Between 5th–10th of each month (for previous month’s books)

Objective: Help clients plan ahead and maintain control.

Tasks

- Build baseline budget model

- Run forecasting models using historical data

- Monthly or quarterly budget vs. actual analysis

- Cash flow projection models for short-term planning

Objective: Build long-term trust and strategic value.

Tasks

- Dedicated email support

- Quarterly review call to:

- Discuss performance

- Adjust budget or forecasting assumptions

- Plan for tax optimization

Objective: Prepare clean year-end accounts for internal/external audit or tax filing.

Tasks

- Review all reconciliations

- Close income/expense accounts

- Adjust entries (depreciation, accruals, provisions)

- Generate trial balance

- Liaise with external auditors (if appointed)

- Create audit-ready working papers (if in scope)

What makes Expert Arm different?

CPA-Certified Expertise (Backed by Global Partnerships)

At Expert Arm, you’re not dealing with a conventional accounting firm — you’re working with a premium fintech and accounting company that blends financial accuracy, global insight, and high-end service. Our teams include professionals certified by some of the most respected finance and accounting bodies in the world, including:

- CPA Australia

- ACCA (UK)

- ICAEW (UK)

- CMA (USA)

- CA (Pakistan & India)

- SOCPA (Saudi Arabia)

- AICPA (USA)

- CFA Institute (USA)

These certifications ensure that your financial statements, audit files, and regulatory filings are compliant with IFRS, GAAP, and local accounting standards — and that your business gets the right advice from the right experts, no matter where you’re operating.

Our bookkeeping and junior accounting staff are also professionals in the making, currently completing their articleships, practical training, or formal qualifications under the direct supervision of these seasoned experts. This means every transaction is not only recorded accurately, but also reviewed through the lens of international compliance, operational efficiency, and financial clarity.

With a strong foundation in outsourced accounting services, multi-jurisdictional tax support, and regulated reporting, Expert Arm gives you the confidence of a world-class finance department — without the overhead.

Fintech-Powered Systems (Streamlined, Scalable, Smart)

At Expert Arm, we don’t just do accounting — we build systems. Our workflows are powered by industry-leading fintech tools and cloud accounting platforms that eliminate bottlenecks, reduce errors, and keep your books running like clockwork.

We work seamlessly with platforms like Xero, QuickBooks Online, Zoho Books, MYOB, and other modern systems — and for clients using ERP platforms or Excel, we customize automation-friendly workflows that adapt to your environment.

You get:

- Real-time reporting dashboards

- Auto-categorized transactions

- Smart document management systems

- Cloud collaboration with full version control and audit trails

By combining automation, platform integration, and human oversight, we give you accounting operations that are not only compliant — but intelligent, scalable, and built for growth.

You Deserve Freedom from the Books

Running a business is hard enough — keeping up with daily bookkeeping, reconciliations, and vendor follow-ups shouldn’t be your job too. At Expert Arm, we believe every founder, freelancer, and finance lead deserves the freedom to focus on growth, not accounting grunt work.

That’s why we adapt to you. Whether you’re running a growing operation with ERP software or bootstrapping your startup in Excel, we provide custom-built systems and hands-on support to match your stage, budget, and ambition.

No matter your size or structure, we take over the accounting burden so you can get back to building your business — while still having full control, clean data, and clear reports.

Quote: “You didn’t start your business to manage bank feeds and ledger codes. We did.”

Confidentiality with Global Capacity

At Expert Arm, discretion is part of the service. We operate silently, securely, and with zero compromise on your financial privacy. Whether you’re a founder handling sensitive investor reports or an established business navigating multi-jurisdictional filings, your data stays protected and your trust stays intact.

Our teams are trained under strict confidentiality protocols, with controlled access, secure cloud environments, and zero third-party exposure without your consent.

We serve clients in Australia, Saudi Arabia, the United Arab Emirates, the United States, the UK, and beyond — with full awareness of regional compliance frameworks, tax laws, and privacy regulations. We don’t just support global business — we’re built for it.

Disclaimer

Expert Arm is a premium fintech and accounting company. We are not a licensed audit firm or a regulated tax agent in any jurisdiction. While we provide a broad range of professional services — including bookkeeping, internal audit support, tax planning, payroll, and financial advisory — certain regulated or certification-based services such as external audits, statutory filings, or legal sign-offs are fulfilled through our network of registered partners and accredited service providers.

We maintain strong working relationships with firms and professionals licensed under:

- ZATCA (Saudi Arabia)

- ATO (Australia)

- HMRC (UK)

- IRS (USA)

- FTA (UAE)

- And other relevant regulatory bodies

This structure allows us to offer complete, compliant, and customized solutions, while ensuring that each part of your financial operation is handled by the most qualified and authorized professionals.